Why you can trust TechRadar

We spend hours testing every product or service we review, so you can be sure you’re buying the best. Find out more about how we test.

Our series on identity theft protection apps will evaluate the features, pricing options, competition, and also the overall value of using each app. However, these are not full hands-on reviews since evaluating identity theft protection apps is almost impossible. It would require several months of testing, purposefully hacking accounts to see if the protection app works, handing over personally identifiable information, performing multiple credit checks, and risking exposure of the reviewer’s personally identifiable information.

Preserving the safety of our identities has become paramount, playing a crucial role in achieving various personal and professional milestones. A secure identity is foundational for maintaining a spotless record, a stellar credit history, and a clean criminal background. These elements serve as the bedrock for financial well-being, enabling individuals to unlock employment opportunities, purchase vehicles and homes, and access bank loans for ventures such as starting a new business. As we navigate this landscape, understanding the implications of identity theft becomes increasingly critical, particularly in light of the surge in online activities we’ve witnessed in recent years, particularly during the pandemic.

The concept of identity theft is no longer a distant worry; it has become a salient threat that looms over individuals in the digital age. This invasive crime can lead to catastrophic disruptions and financial devastation. Unfortunately, many people harbor the hope that they will never fall victim to such deceit; the stark reality is that identity theft can happen to anyone, regardless of how prudent or careful they may be. Identity theft typically occurs when someone unlawfully acquires and exploits another individual’s personal information—such as their name, address, social security number, or credit card details—for fraudulent purposes. The repercussions are often far-reaching and can linger for years, affecting every aspect of a victim’s life.

One of the most immediate and devastating impacts of identity theft is the inability to access financial resources. When personal information is compromised, banks and lenders may abruptly deny loans or credit applications, leaving victims in a precarious financial position. This disruption can hinder individuals from purchasing essential items like homes, cars, or securing personal loans necessary for everyday life. Additionally, victims may find their existing financial accounts frozen or compromised, further exacerbating the situation and preventing them from accessing their own hard-earned funds to meet their financial obligations.

Employment opportunities, too, can be negatively affected by the ramifications of identity theft. Many employers conduct background checks as part of their hiring process, and if discrepancies or red flags associated with a victim’s stolen identity are flagged, it can lead to job rejections or even terminations. This loss of income can be particularly devastating, leaving individuals struggling to provide for themselves and their families.

Beyond the tangible financial consequences, the emotional toll of identity theft can be equally devastating. Victims often report feelings of violation, anger, and helplessness as they grapple with the breach of their personal security. The process of restoring one’s identity and repairing damaged credit can be not only time-consuming but also financially burdensome, requiring significant emotional resilience. Moreover, identity theft can foster social isolation, as victims may become wary of engaging in everyday activities that necessitate sharing personal information, eroding their trust in others.

In a world where identity theft poses a significant and growing threat, taking proactive measures to safeguard personal information has become essential for everyone. Individuals can fortify their defenses by employing robust passwords, implementing two-factor authentication on various accounts, and exercising caution when sharing sensitive data online. Regular monitoring of credit reports and bank statements enables timely detection of suspicious activities, serving as an early warning system for potential compromises. Additionally, identity theft protection services offer an extra layer of security, often providing assistance in the event of account breaches and credit restoration.

For those concerned about identity theft, services such as IDShield are worth considering. This product emphasizes fraud intervention by deploying licensed private investigators who act on behalf of victims. By granting them Power of Attorney, individuals can ensure that these professionals navigate the complexities of credit agencies to restore their good name effectively. However, while IDShield offers notable services, there are concerns regarding its efficacy. An ideal identity theft protection app should be more proactive in preventing fraud rather than merely addressing it post-incident. Additionally, some users have expressed frustration with unclear explanations on their website, which can create confusion about the specifics of what the product actually offers.

Plans and pricing

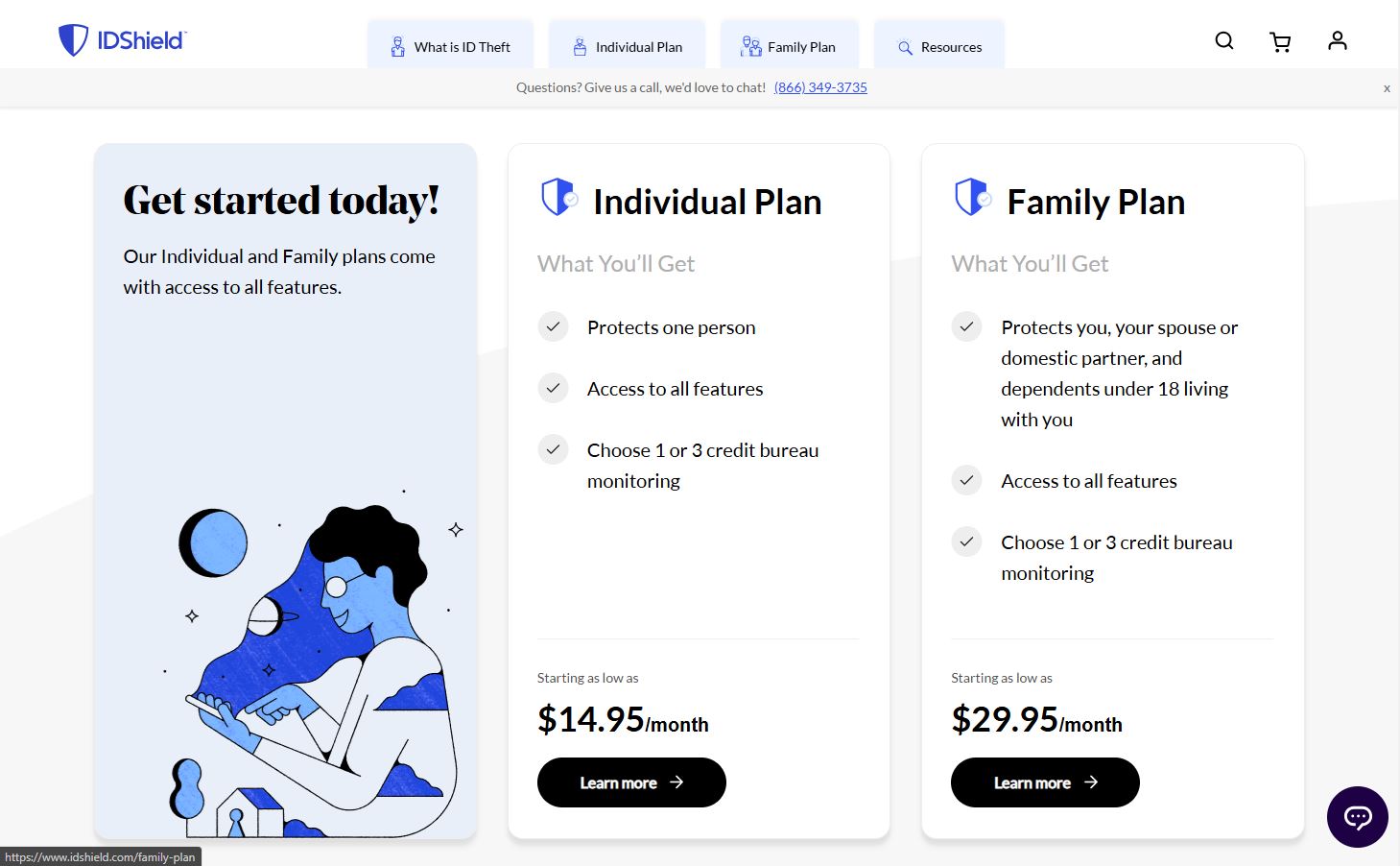

IDShield offers straightforward plans designed to protect individuals and families from identity theft, with pricing that varies primarily based on whether you opt for one-bureau or three-bureau credit monitoring.

For individuals, plans typically start around $14.95 per month for one-bureau credit monitoring (usually Experian). If you desire more comprehensive credit oversight, the three-bureau option (monitoring Experian, TransUnion, and Equifax) is available for approximately $19.95 per month.

For families, IDShield provides coverage for two adults and eligible dependent children under 18 living in the same household. A one-bureau family plan typically costs around $29.95 per month, while the three-bureau family plan is approximately $34.95 per month. Some sources indicate the family plan covers an unlimited number of children.

Regardless of the plan you choose, all IDShield subscriptions come with a robust set of features. These include dark web monitoring, social security number (SSN) monitoring, financial account monitoring, social media monitoring, public records monitoring, and alerts for various identity threats like address changes and court records. A significant benefit across all plans is access to licensed private investigators who will work to fully restore your identity if it’s stolen, alongside up to $3 million in identity theft insurance to cover eligible financial losses and certain legal fees. Many plans also bundle in digital security tools like a VPN and password manager for up to three devices on individual plans and up to 15 devices on family plans, typically provided by Trend Micro. It’s worth noting that while credit monitoring is a core feature, some plans may not provide full credit reports, only a monthly credit score tracker. IDShield often provides a 30-day free trial for new members.

Interface

Before discussing the desktop and mobile apps, it’s imperative to highlight the IDShield website. Unlike other apps that can be downloaded and used right away, identity theft protection requires some self-education. Understanding the field of identity theft, including how criminals can harm your reputation, destroy your credit, and even impersonate you to commit crimes, is essential.

Despite its efforts, IDShield encounters some obstacles in conveying critical information. The primary website provides descriptions of the app’s features, but the “See more” option that elaborates on additional functionalities is easily overlooked due to its diminutive size.

Furthermore, the consultation feature’s description lacks specifics, leaving out crucial details. It merely states that “We monitor your personal and financial information 24/7. When we detect fraud, we work to restore your identity quickly.” However, without some more specifics, it fails to provide any meaningful information about the restoration process or the actual steps taken to return consumer reports and other records to their pre-theft status. This generic description leaves potential customers with some unanswered questions and an unclear understanding of the services provided.

Mobile app

Within the app, just like in other sections, there’s a lack of detailed explanations about the features’ functionality. In contrast, Norton LifeLock excels in presenting options in a dashboard layout, similar to a wizard. It clearly indicates the remaining steps or the number of accounts that require configuration.

IDShield places too much emphasis on your credit score. Some of the information intended to explain features actually ends up explaining general credit monitoring concepts. This issue persists not only in the desktop app but also in the mobile apps for iPhone iOS and Android.

Features

IDShield lacks substantial features, except for the consultation with licensed investigators. This service primarily addresses issues that arise after identity theft has already occurred. The app monitors credit bureaus and sends alerts for credit-related problems, allowing users to address them promptly before they become severe, such as a low credit score. However, some of these features are repetitiously listed, causing inconvenience.

On the IDShield website and in a feature comparison document, “Unlimited consultation” and “Licensed private investigators” are listed. However, these phrases essentially convey the same idea. Another example is social media monitoring, which is not as impressive as it seems. It primarily tracks illicit images, drug references, and foul language, but it does not monitor for account hacking.

IDShield excels in its vigilance in safeguarding your identity. While Norton LifeLock offers superior tools for identity protection, IDShield surpasses it in monitoring the usage of your personal information, such as your address, phone number, and other identifiable details. IDShield’s capabilities extend to tracking public court records and detecting pay-day loan fraud attempts made with your name and identity.

One standout feature of IdentityForce is its capability to alert users when a registered sex offender moves into their neighborhood. However, it’s worth noting that the app currently lacks the ability to notify users if a sex offender attempts to steal their identity. This could be a valuable addition to the app, as it would provide users with a more comprehensive identity protection solution.

Support

IDShield understands that customers may have questions or concerns about their services, and they offer multiple support channels to ensure timely and convenient assistance.

For immediate assistance, customers can call IDShield’s dedicated phone support line at 1-888-494-8519. Phone support is available from Monday through Friday, from 7 AM to 7 PM Central Standard Time (CST). Customers can speak directly to knowledgeable representatives who are trained to address a wide range of issues, from account inquiries to technical support.

For customers who prefer written communication, IDShield offers email support at Idshield@legalshield.com. Customers can send detailed queries or concerns to this email address anytime, and they can expect a response within 24 hours. This option is particularly suitable for non-urgent matters or complex inquiries that require more comprehensive explanations.

IDShield’s website features a live chat option for customers who prefer real-time assistance. The live chat function allows customers to connect directly with a support representative and have their questions answered promptly. This option is available during business hours, and customers can initiate a chat by clicking the “Live Chat” button on IDShield’s website.

In addition to these support channels, IDShield also provides a comprehensive knowledge base and frequently asked questions (FAQs) section on their website. Customers can find answers to common questions, troubleshooting tips, and other resources without contacting support directly.

IDShield’s commitment to customer satisfaction is evident in their diverse support options. By offering phone, email, and live chat support, IDShield ensures that customers have convenient and accessible channels to resolve their queries and concerns.

The competition

In today’s digital age, the threat of identity theft has become increasingly prevalent, prompting consumers to seek robust identity theft protection services. IDShield operates in a competitive landscape, where several strong players vie for attention with their comprehensive offerings.

Among these, Aura stands out as a prominent competitor, frequently receiving high marks for its all-in-one approach to digital security and identity protection. Aura distinguishes itself by bundling essential features like a virtual private network (VPN), antivirus software, and thorough dark web monitoring with its identity theft services. This integration of tools provides users with a holistic security solution, allowing for a seamless experience. Additionally, Aura’s three-bureau credit monitoring, included across all plans, enables users to gain a complete view of their credit status, enhancing their ability to detect fraudulent activities promptly.

Another key competitor in this space is Norton LifeLock, a well-established name recognized for its extensive suite of monitoring features. LifeLock offers an array of services that extend beyond typical identity theft protection. Users benefit from comprehensive monitoring of their credit and financial activities, as well as unique features like home and auto title monitoring. This focus on a broad spectrum of identity protection resonates with consumers looking for a more integrated solution. Moreover, the incorporation of Norton 360 antivirus with LifeLock subscriptions appeals to those seeking to combine cybersecurity with identity theft protection, ensuring that users’ devices are safeguarded against various online threats.

Identity Guard is another significant player that has garnered attention for its strong monitoring capabilities, leveraging artificial intelligence to detect threats swiftly. This technological advancement allows Identity Guard to provide proactive alerts and real-time monitoring, which can be invaluable for users keen on staying one step ahead of potential fraud. The service typically offers a range of plans at various price points, making it accessible to a wider audience. This flexibility can be particularly appealing for consumers primarily focused on alerting and monitoring, rather than extensive recovery services.

Beyond these top contenders, other notable services such as IdentityForce also provide substantial protection, incorporating features like social media monitoring and personal identity safety scores. Such tools help users maintain an awareness of their online presence and identify potential risks associated with their digital identity. Experian IdentityWorks and ID Watchdog stand out for their strong ties to credit bureaus, offering users a direct link to credit monitoring services that can provide significant peace of mind, especially in times of heightened concern about financial security.

As identity theft protection continues to evolve, companies like McAfee and Bitdefender are increasingly integrating these services into their broader cybersecurity suites. By bundling antivirus capabilities, VPN access, and identity protection, they create an all-encompassing security solution that appeals to users looking for comprehensive protection under one roof.

Ultimately, the choice among these competitors often comes down to individual needs, budget constraints, and the desired level of credit bureau monitoring. Factors such as additional features, like enhanced digital security tools or personalized restoration services, can also play a crucial role in the decision-making process. Consumers must carefully evaluate their priorities and preferences to find the identity theft protection service that best meets their unique requirements in this ever-evolving digital landscape.

Final verdict

IDShield could benefit significantly from rebranding with a more fitting name. Since its primary focus is on collaborating with investigators to handle fraud cases, a name like “IDRestore” would better align with its core function. This strategic change in naming would provide a clearer and more accurate representation of the app’s services.

When comparing IDShield to its competitors, it stands out as a cost-effective option. Its pricing structure makes it an accessible choice for individuals and families seeking protection against identity theft. The affordability of IDShield makes it a practical solution for those who prioritize financial security without overspending.

Despite its low cost, IDShield does not compromise on the quality of its services. The app employs robust security measures and advanced technologies to protect users’ personal information. Its user-friendly interface and comprehensive features enable users to monitor their credit reports, detect suspicious activities, and receive real-time alerts easily.

By offering a competitive price point alongside effective identity protection services, IDShield presents an attractive value proposition. Its commitment to providing affordable yet reliable solutions makes it a compelling choice for individuals and families looking to safeguard their personal information in an increasingly digital world.

Take a look at our full guide to the best identity theft protection

Leave a Comment

Your email address will not be published. Required fields are marked *